Historically finance has played a pivotal role in performance management. From reporting on actual financial performance and forecasting future financial performance.

This role could only be performed by having sufficient knowledge of the various processes within the business, having a cross-functional view of the business and having the basic accounting skills in place.

For most finance functions the new realities of increased complexity has resulted in finance focusing more and more on their basics (accounting and financial reporting) and less on their role of controlling the business (strategy execution). This new reality has also caused substantial changes in the capabilities currently present within the finance function; current capabilities in finance are related to compliance (financial) and less and less to business understanding, control, and information management.

Role of Finance

The finance function in my opinion is currently at a point to make fundamental decisions on their task/purpose in the organization and on how to organize this. It is now almost impossible to keep acting as a Jack-of-all-trades. A CFO nowadays is almost superhuman in controlling all the various aspects of the organization. It is not uncommon for the CFO to be involved in strategy, commercial negotiations, marketing, IT, health, safety and environmental discussions, HR, production, sourcing and so on. This all on top of the basic responsibility of financial management (accounting, reporting, budgeting, tax, treasury/cash management).

The first question to be answered by the CFO is what roles he wants to play, taking into account that he cannot do all. To help in making this decision he needs to be aware of his environment: what does the business want, expect from finance. Is it mere compliance or is a more senior role in decision support and performance management needed? Nowadays all CFO's and Finance Director are talking about becoming a business partner, without clearly defining it. CFO's need to start with clearly stating the value proposition of finance in terms of the business; ultimately it is the business that decides on what role finance needs to perform. In some cases this means that finance needs to be geared towards the basic accounting tasks and compliance, in other organizations finance needs to take on a different role, more toward information manager and business improver.

Having clarity on the role is a vital start. Next finance needs to work on how to organize for this role. What are the key processes and how do they need to be resourced (or outsourced?)? What distribution and communication channels need to be developed in order to effectively perform the role? What core capabilities do I need?

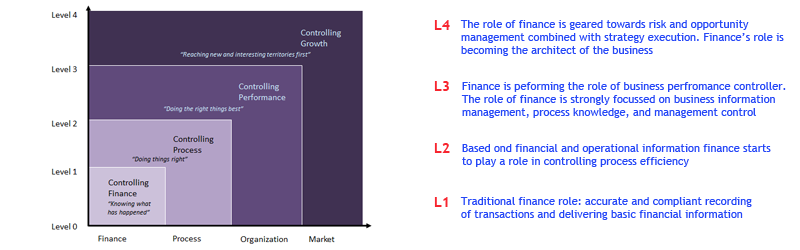

The picture at the top of the page represents in effect four different roles finance can take on in the area of performance management:

- Level 1: finance focuses on its historical role of accurate transaction posting and providing basic financial information. Finance is focusing on efficient transaction processes and (financial) compliance (e.g. Sox)

- Level 2: in this role finance is expected to analyze operational processes and assist in improving processes (moving them from bad to good). Finance has most efficiently organized its basics and has developed capabilities in the area of business process management and process control.

- Level 3: In this role finance main role is becoming an information broker. Finance core capabilities are now moving towards Information Management, management control and strategy execution. Accounting and process control need to be organized as efficiently as possible.

- Level 4: in this role finance is acting as the architect to continuously align the organization and its control framework with the (changing) strategy of the organization.

As you can see from the various roles, finance is moving further away from its basic financial tasks (from financial to strategic control). It is therefore important that the finance function is aware of its primary role. In case the primary role does not allow finance to progress in the level of performance management support, performance management support should be placed outside of the finance function.

To some CFO's it does not sound very appealing or sexy to not move into the business role, but it is vital for the success of the organization that everyone plays the role the organization asks of them. So defining the role and performing it to the best of your ability is the most important contribution of finance to performance management.